In this article, we will learn How to calculate Compound Interest in Excel.

What is Compound interest ?

Compound Interest is a financial term, which is when addition of interest to the principal sum of a loan or deposit. You must be confusing it with Simple Interest or called nominal Interest. Nominal Interest is the Interest paid over the period without inflation. So Interest calculated over the inflated amount is called Compound interest.

Compound Interest => A = P(1 + r/n)^nt

A - compound interest

P - Initial amount

r - Interest rate

n - number of periods per time period

t - time elapsed

Compound interest formula using FV Function in Excel

Future value function returns the future value of the present amount having interest rate over a period.

Syntax:

| =FV (rate, nper, pmt, [pv], [type]) |

rate: Interest rate per period

nper: total no. of payment period.

pmt: amount paid each period.

pv - [optional] The present value of future payments must be entered as a negative number.

type - [optional] When payments are due. Default is 0.

Example :

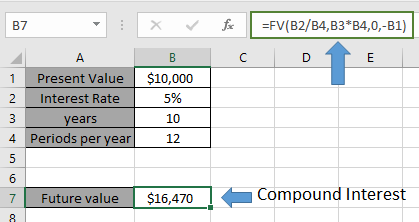

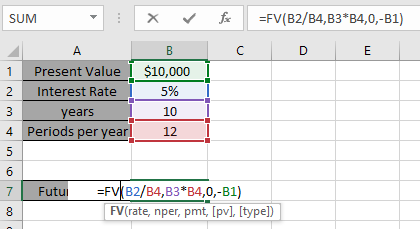

All of these might be confusing to understand. Let's understand how to use the function using an example. Here

Excel Compound interest formula

| =FV(B2/B4,B3*B4,0,-B1) |

B2/B4: rate is divided by 12 as we are calculating interest for the monthly period.

-B1: present amount to be considered as negative to get the return in negative.

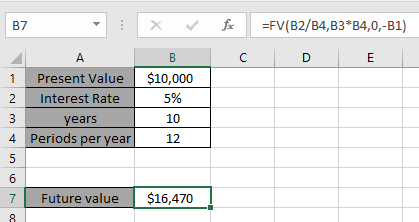

Compound Interest for the following data will be

As you can see future value gets the compound interest for the data.

Another example

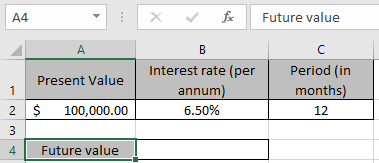

Here we have the amount of $100,000 as present value considered over a period of year (12 months) at a rate of 6.5%.

And we need to find the new amount for the data after one year. We will use the FV function formula to get that new amount or future value.

Use the Formula:

| = FV ( B2/12 , C2 , 0 , -A2 ) |

Explanation:

B2/12 : rate is divided by 12 as we are calculating interest for monthly periods.

C2 : the total time period (in months)

0 : no amount paid or received between the total period

-A2 : amount is in negative so as to get the future value amount in positive.

Here arguments to the function are given as cell reference.

Press Enter to get the result.

This function returns a value of the amount $106,697.19 as future value for the dataset.

Here are all the observational notes using the compound Interest in Excel

Notes :

Hope this article about How to calculate Compound Interest in Excel is explanatory. Find more articles on calculating amount, interest rate, return values and related Excel formulas here. If you liked our blogs, share it with your friends on Facebook. And also you can follow us on Twitter and Facebook. We would love to hear from you, do let us know how we can improve, complement or innovate our work and make it better for you. Write to us at info@exceltip.com.

Related Articles :

How to use the MIRR function in excel : returns the Modified interest rate of return for the financial data having Investment, finance rate & reinvestment_rate using the MIRR function in Excel.

How to use the XIRR function in excel : returns the Interest rate of return for irregular interval using the XIRR function in Excel

Excel PV vs FV function : find Present Value using PV function and future value using FV function in Excel.

How to use the RECEIVED function in excel : calculates the amount which is received at maturity for a bond with an initial investment (security) and a discount rate, there are no periodic interest payments using the RECEIVED function in excel.

How to use the NPER function in excel : NPER function to calculate periods on payments in Excel.

How to use the PRICE function in excel : returns the price per $100 face value of a security that pays periodic interest using the PRICE function in Excel.

Popular Articles :

How to use the IF Function in Excel : The IF statement in Excel checks the condition and returns a specific value if the condition is TRUE or returns another specific value if FALSE.

How to use the VLOOKUP Function in Excel : This is one of the most used and popular functions of excel that is used to lookup value from different ranges and sheets.

How to use the SUMIF Function in Excel : This is another dashboard essential function. This helps you sum up values on specific conditions.

How to use the COUNTIF Function in Excel : Count values with conditions using this amazing function. You don't need to filter your data to count specific values. Countif function is essential to prepare your dashboard.

The applications/code on this site are distributed as is and without warranties or liability. In no event shall the owner of the copyrights, or the authors of the applications/code be liable for any loss of profit, any problems or any damage resulting from the use or evaluation of the applications/code.